Modern Portfolio Management: Active Long/Short 130/30 Equity Strategies : Leibowitz, Martin L., Emrich, Simon, Bova, Anthony: Amazon.it: Libri

![PDF] Portfolio Optimization with Factors, Scenarios, and Realistic Short Positions | Semantic Scholar PDF] Portfolio Optimization with Factors, Scenarios, and Realistic Short Positions | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/1100982151263d172609dc74dd5983780a3ae168/10-Table1-1.png)

PDF] Portfolio Optimization with Factors, Scenarios, and Realistic Short Positions | Semantic Scholar

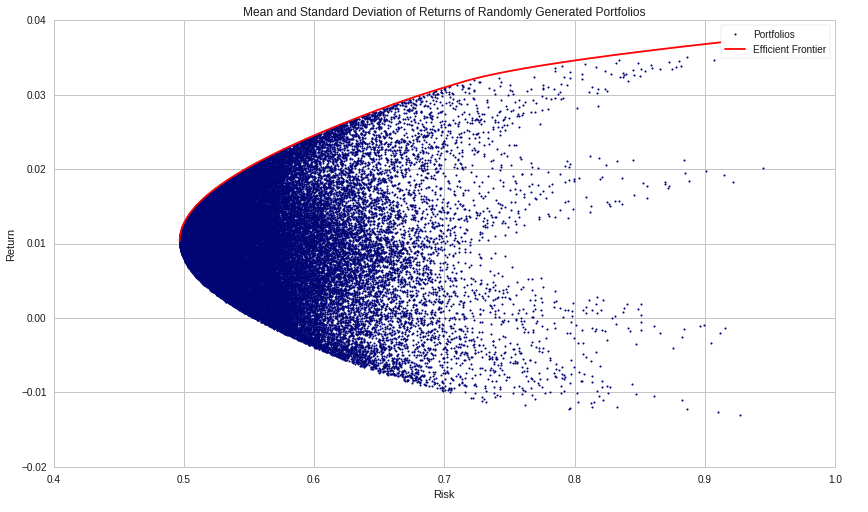

Quant Bible | Portfolio Optimization for 20 Securities Using Lagrange Multipliers, No Short-Selling, Weights Sum to 1

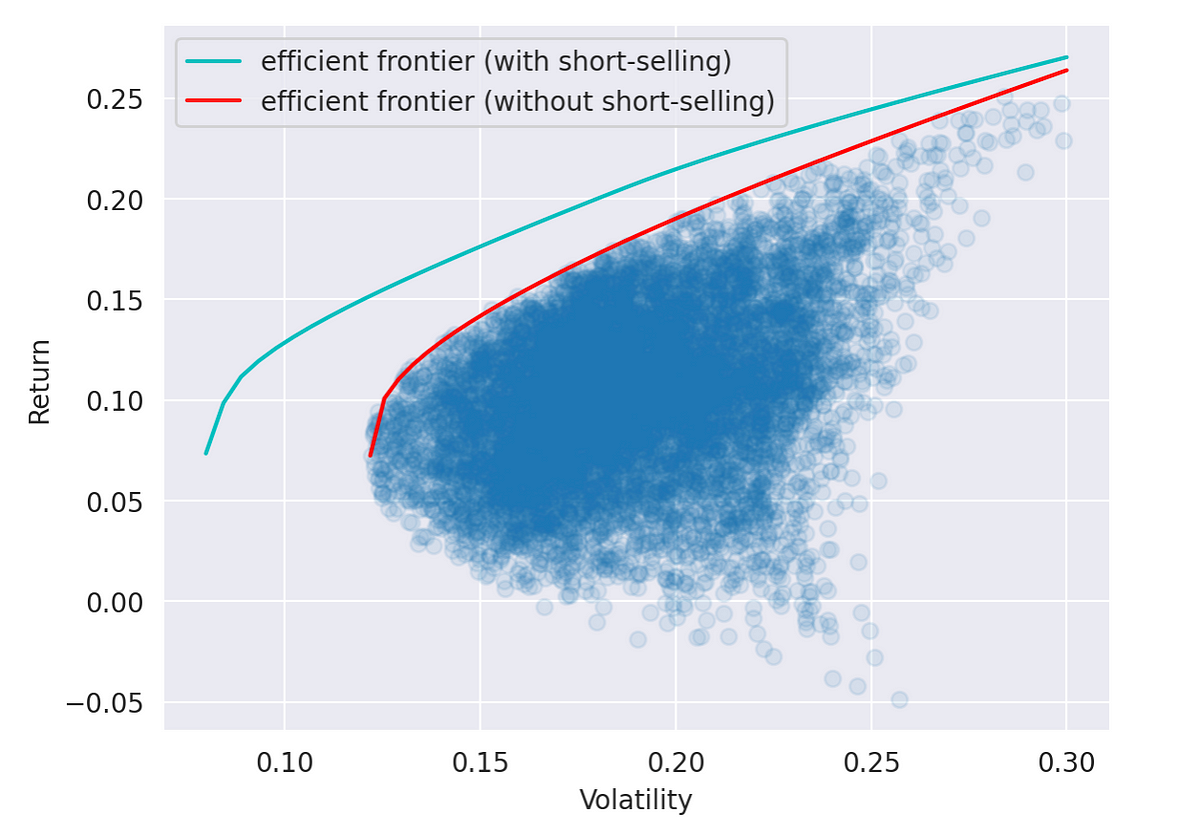

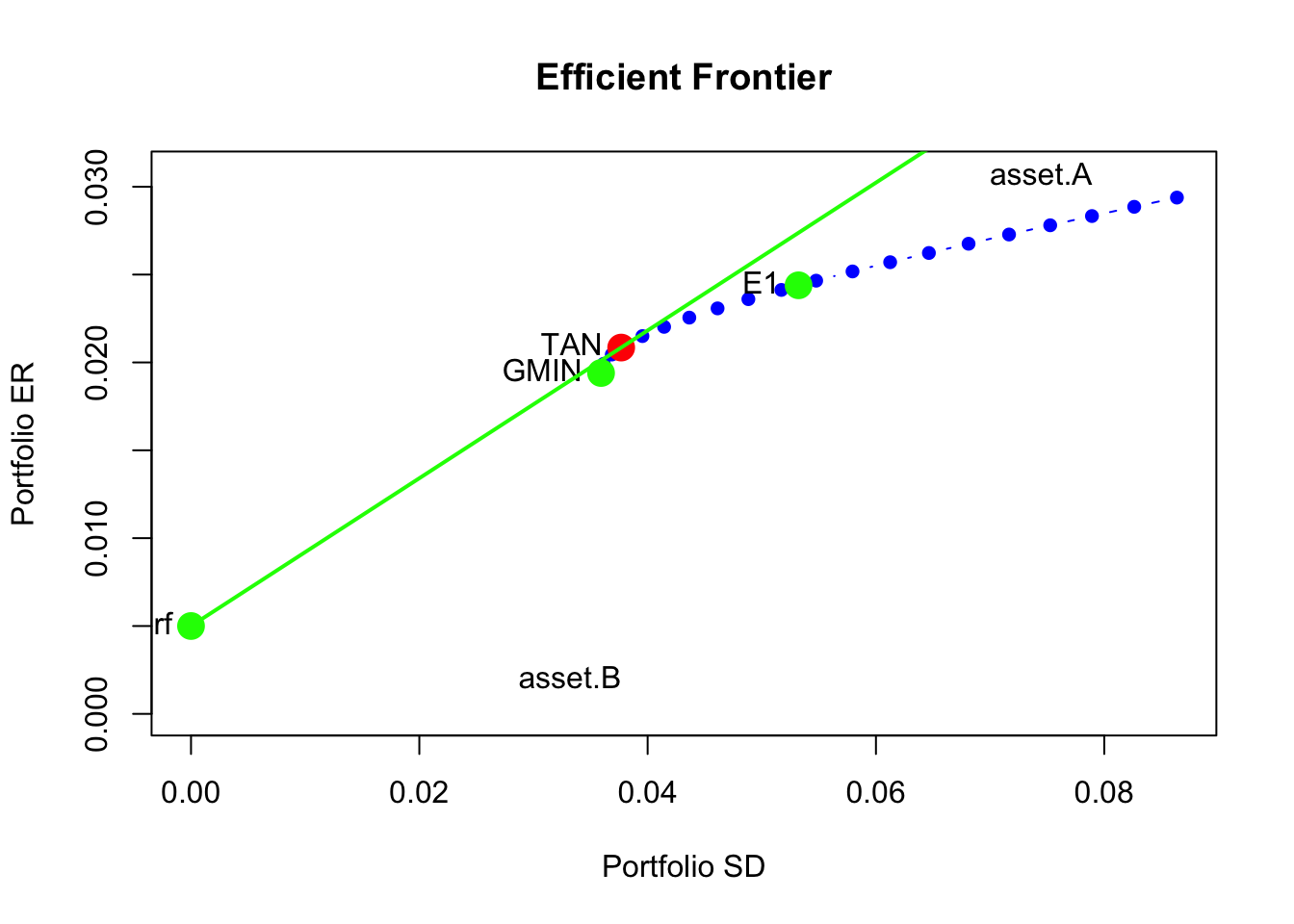

Python for Finance: Portfolio Optimization and the value of Diversifying. | by Nicolás Besser | Medium

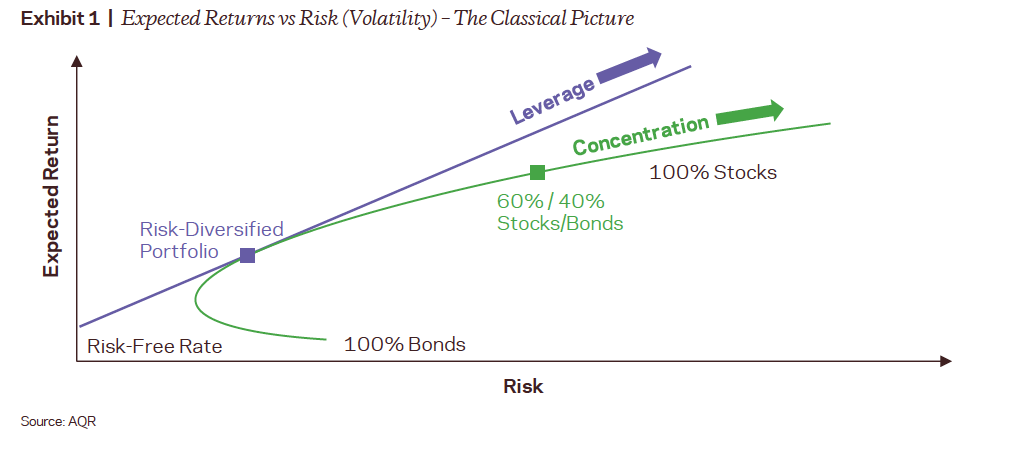

The Smart Money Prefers Long/Short Portfolios, But The Vast Majority Of AUM Is Long-Only | Seeking Alpha

LSTM-DNN model and long-short portfolio construction. The yellow part... | Download Scientific Diagram

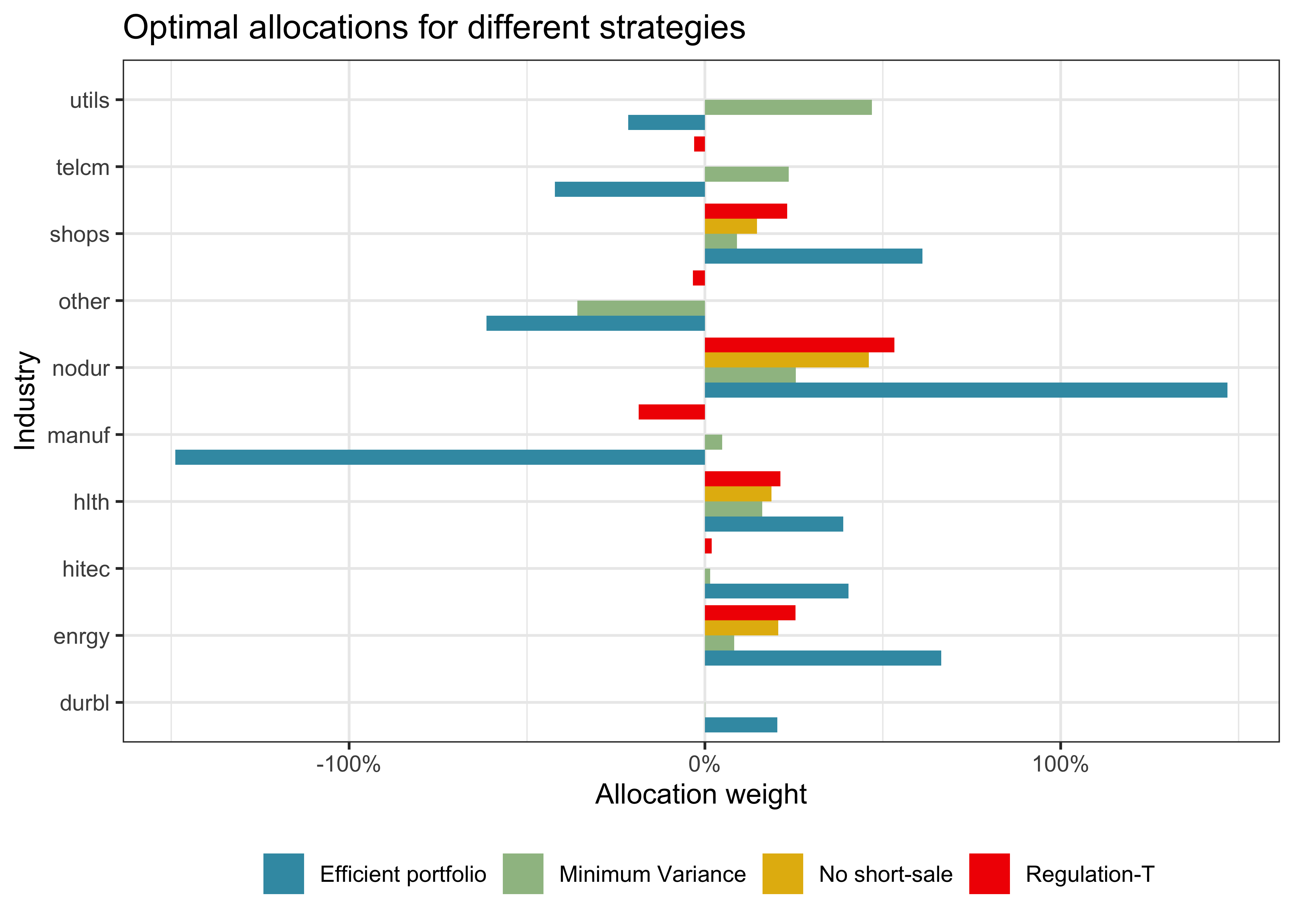

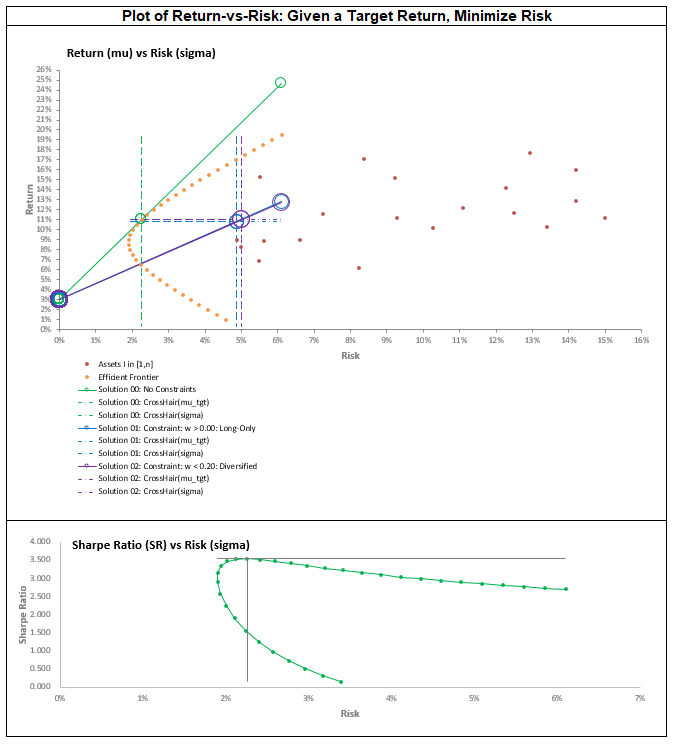

The impact of regulation-based constraints on portfolio selection: The Spanish case | Humanities and Social Sciences Communications

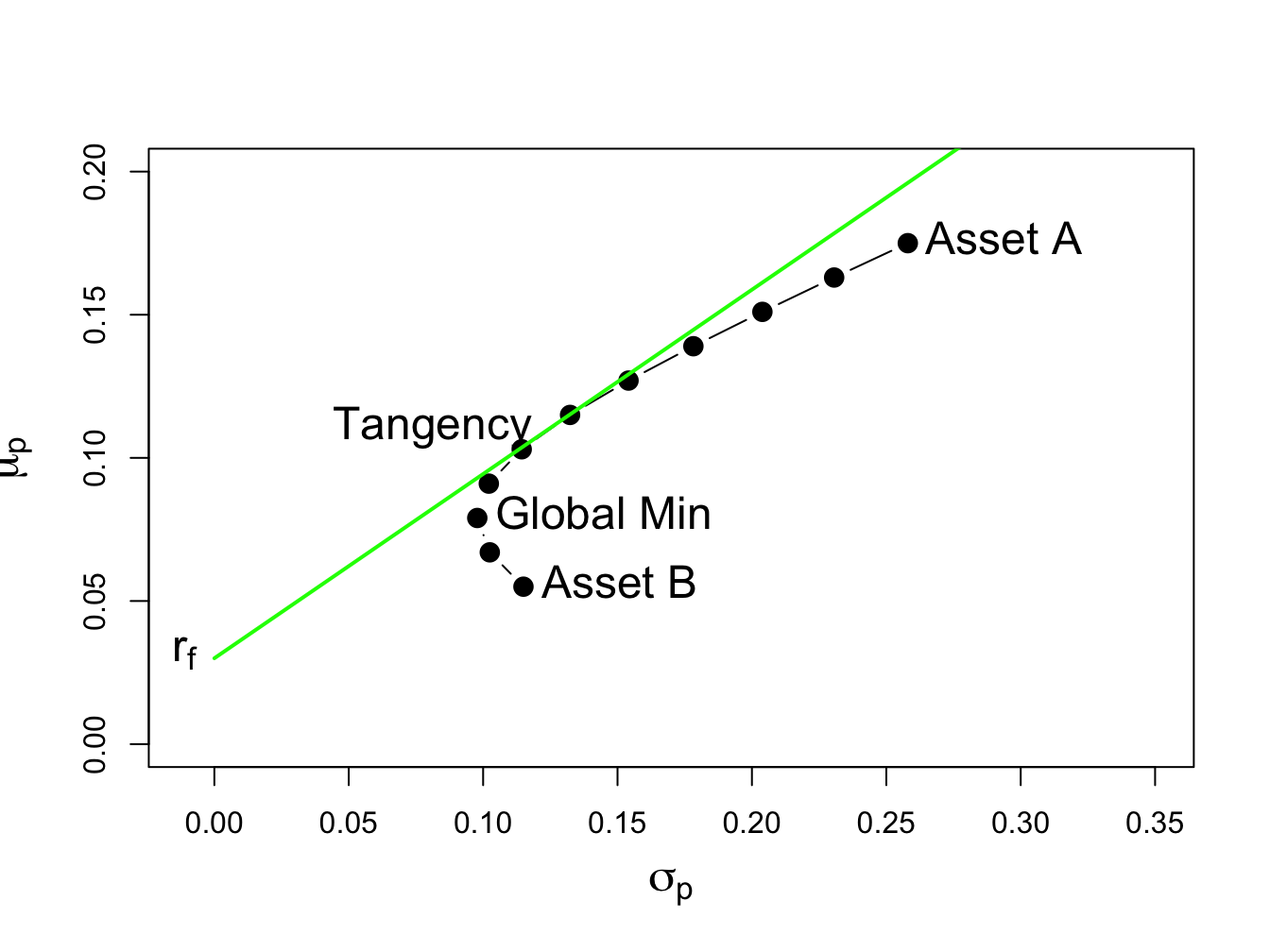

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

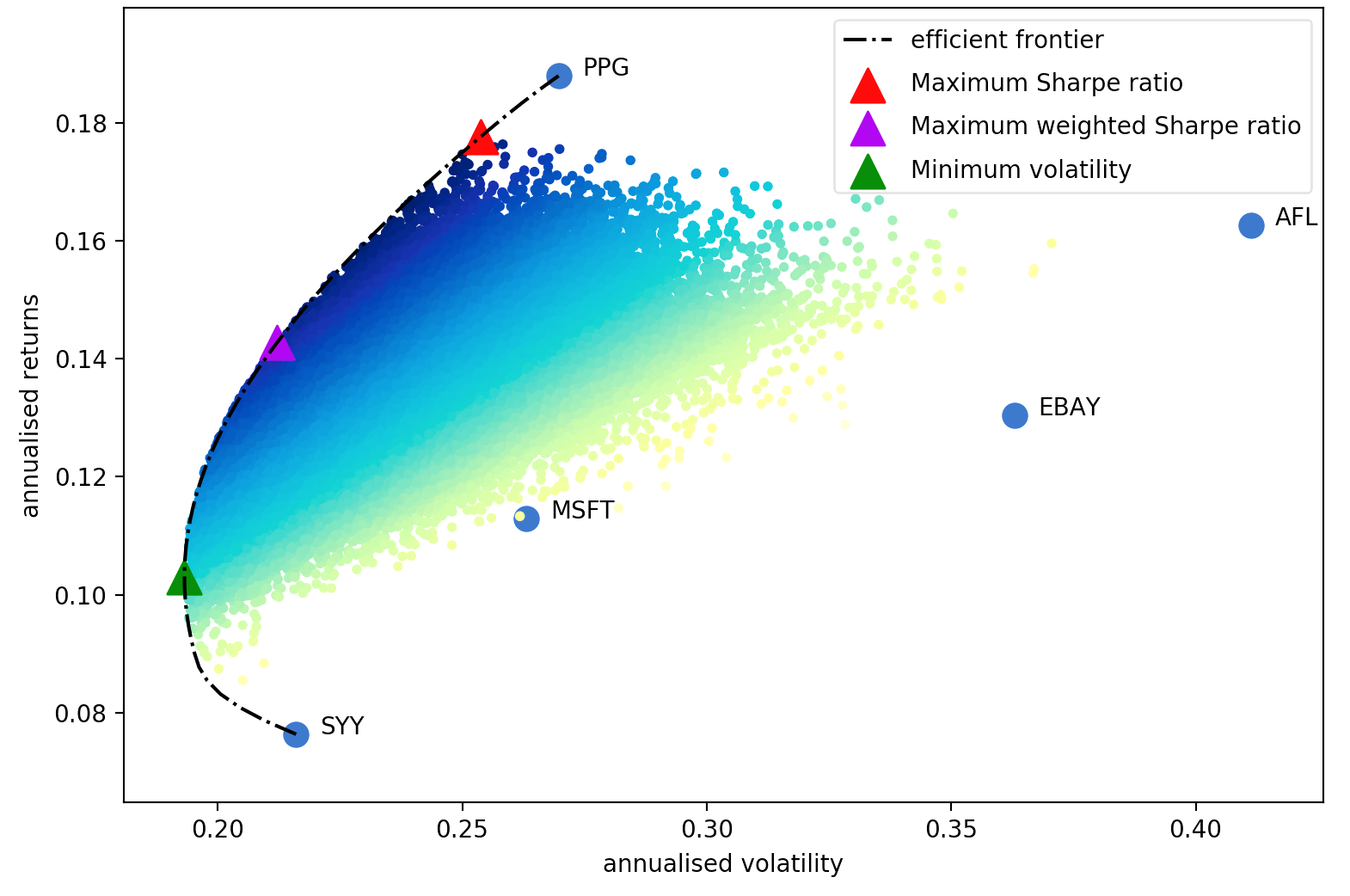

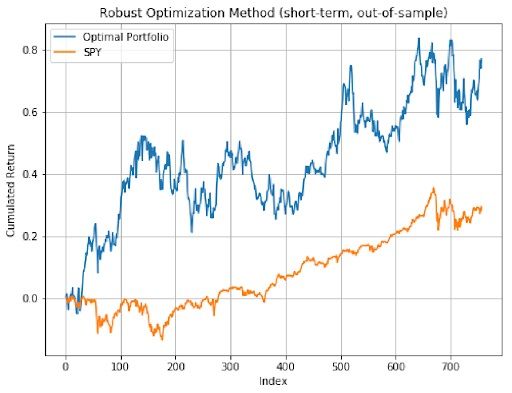

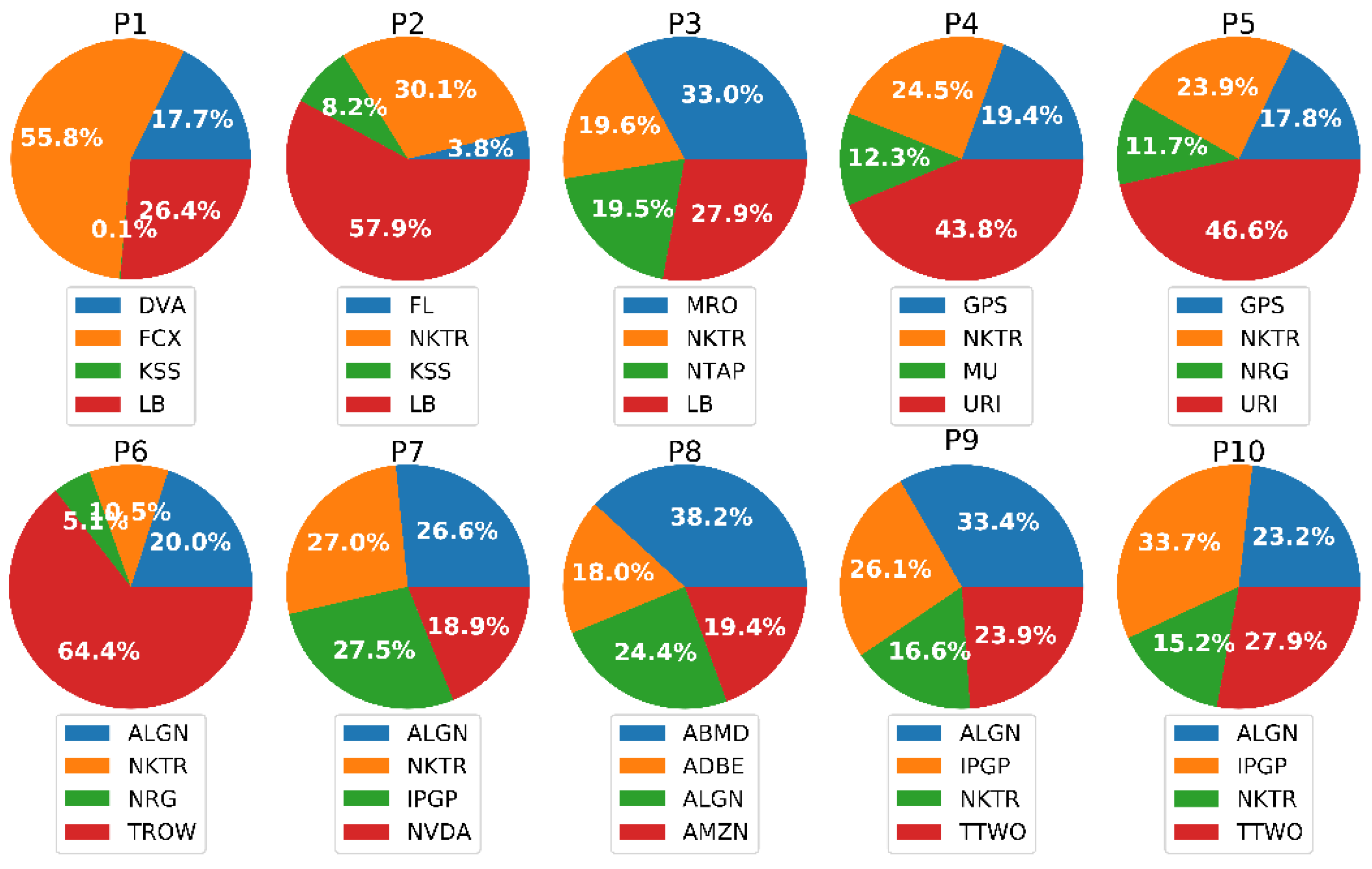

GitHub - georgemuriithi/investment-portfolio-optim: An investment portfolio of stocks is created using Long Short-Term Memory (LSTM) stock price prediction and optimized weights. The performance of this portfolio is better compared to an equally

Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading